In today’s Crypto for Advisors, Bryan Courchesne from DAIM provides information on tax planning for crypto trades. Although we are half a year away from tax season, there are many considerations to track in order to be tax-ready.

Then, Saim Akif from Akif CPA breaks down the differences in tax treatment between crypto and equities/bonds in Ask an Expert.

Crypto Taxes Are Complicated, Don’t Let Them Derail Your Portfolio

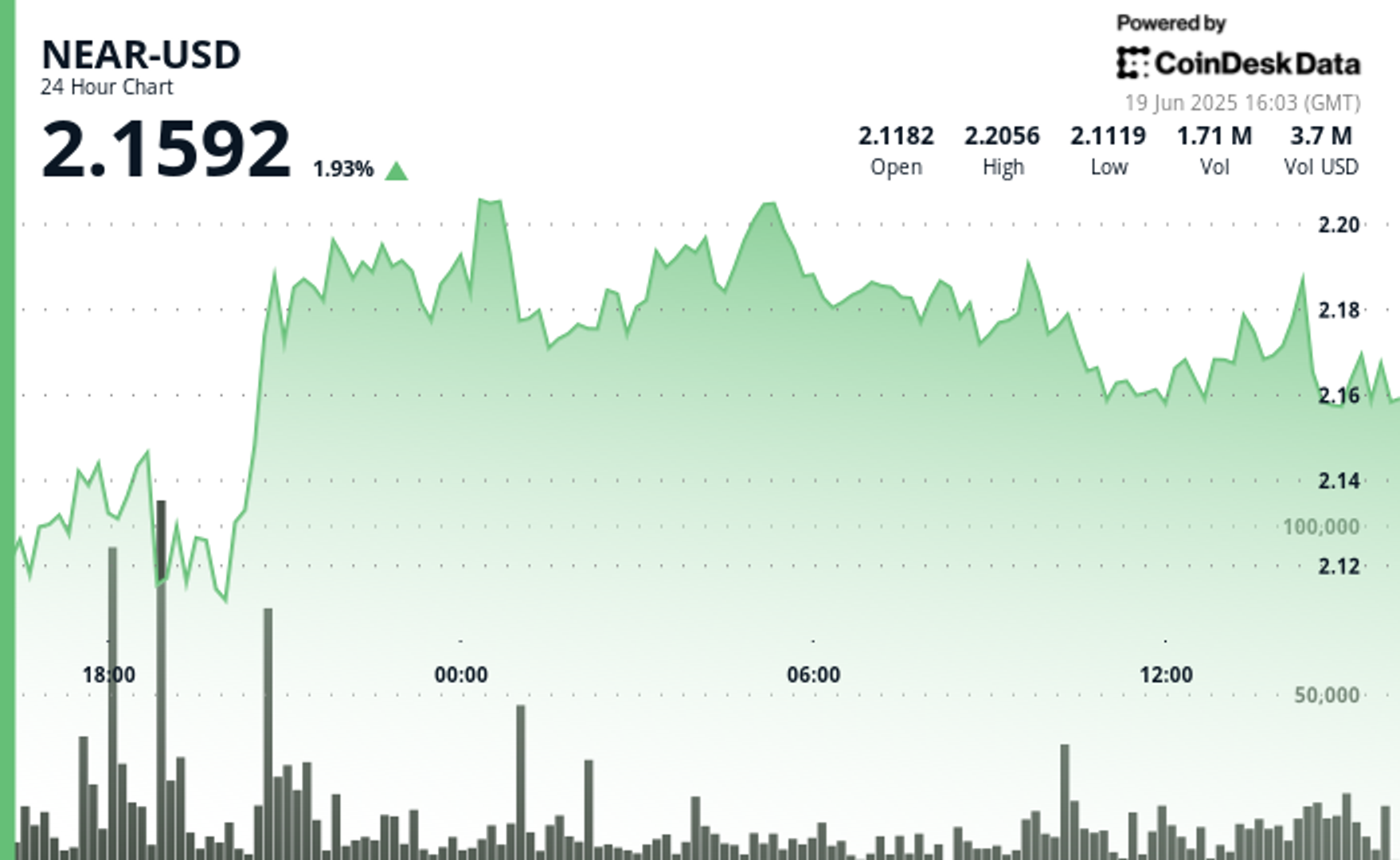

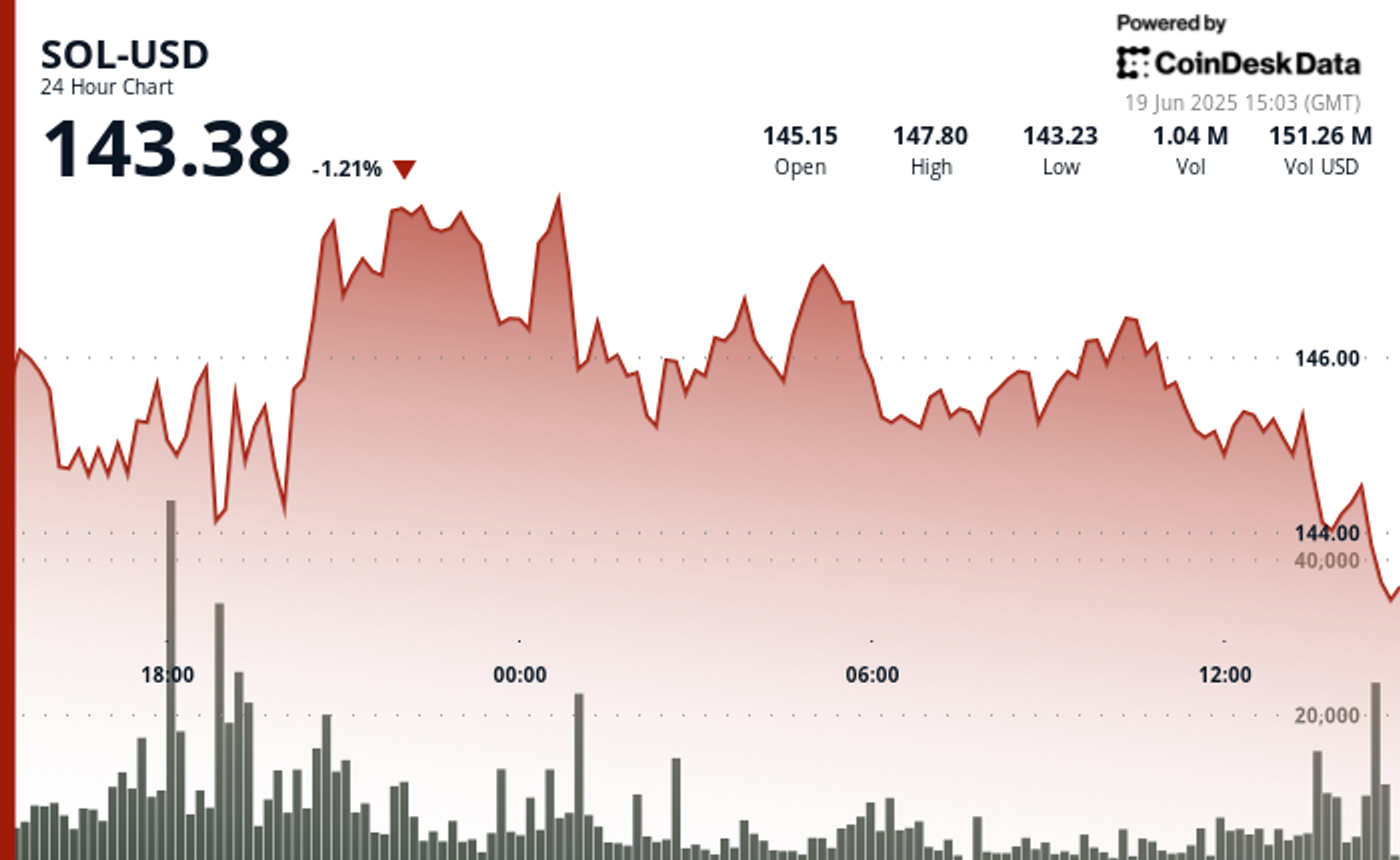

As advisors focused on crypto, we’re familiar with the unique tax situations this asset class presents. For example, crypto is not subject to wash-sale rules, which allows for more efficient tax-loss harvesting. It also enables direct asset swaps, such as converting bitcoin (BTC) to ether (ETH) or ETH to Solana (SOL), without first selling into cash. These are just a couple of features that set crypto apart from traditional investments.

However, perhaps the most important thing for investors to consider is the sheer number of platforms they may use and how challenging it can be to track everything at tax time.

Tracking your crypto taxes isn’t just a year-end chore; it’s a year-round challenge, especially if you’re active on multiple centralized exchanges (CEXs) or decentralized platforms (DEXs). Every trade, swap, airdrop, staking reward, or bridging event can be a taxable event.

Centralized Exchange Trading

When using CEXs like Coinbase, Binance, or Kraken, you may receive year-end tax summaries, but those are often incomplete or inconsistent across platforms. One major challenge is tracking your cost basis across exchanges.

For example, if you buy Amazon stock in a Fidelity account and transfer it to Schwab, your cost basis transfers seamlessly and updates with each new trade. At tax time, Schwab can generate an accurate 1099 showing your gains and losses.

But in crypto, if you transfer assets from Kraken to Coinbase, your cost basis doesn’t automatically transfer with them. If you’re moving assets across multiple platforms, you’ll need to manually track every transaction, or you’ll face a major headache when filing taxes.

Decentralized Exchange Trading

Things get even more complicated when using DEXs. Apps like Coinbase Wallet (not to be confused with the Coinbase exchange) or Phantom connect you to decentralized trading platforms like Uniswap or Jupiter. These DEXs don’t issue tax forms or track your cost basis, so it’s entirely up to you to log and reconcile every transaction.

Miss a single token swap or forget to record the fair market value of a liquidity pool withdrawal, and your tax report could be inaccurate. That could trigger IRS scrutiny or lead to missed deductions. While some apps can calculate gains and losses from a single wallet address, they often struggle when assets are transferred between addresses, making them less useful for active users.

And here’s the kicker: if you’re actively trading on DEXs, chances are you’re not even making money. But even losses must be reported correctly to qualify for a deduction. If not, you risk losing the write-off or, worse, facing an audit.

Unless you’re a full-time crypto trader, the time and effort required to track every transaction isn’t just stressful, it can cost you real money.

What steps can I take to make sure I’m tax ready?

There are, however, several ways to prepare properly for crypto taxes:

- Use crypto tax software from the beginning. Even then, you’ll want to double-check that the reported activity makes sense and adjust as needed.

- Hire a crypto tax specialist or work with a crypto-focused advisor who understands the landscape.

- Download all transaction logs and see if your CPA or advisor can help build a cost basis and determine your realized gains and losses.

As adoption increases, tax reporting will undoubtedly evolve — in the meantime keeping track of your trade activity is important to be ready for tax season.

Ask an Expert

Q. Why are advisors watching crypto closely?

A.Institutional crypto inflows have surged to $35 billion. While crypto is more volatile than traditional assets, major cryptocurrencies like bitcoin, have historically outperformed other traditional asset classes since 2012.

Q. How is crypto being treated differently from equities/bonds from a tax side?

A. Crypto differs fundamentally from equities and bonds. Advisors must track each wallet separately for cost basis (starting Jan 2025). Unlike traditional 1099s, clients often get little to no reporting support from exchanges, especially for self-custodied assets.

Q. Do you have any special insights for CPAs and tax advisors?

A. Compliance isn’t optional anymore. Starting with 2025 returns:

- Wallet-level cost basis reporting is mandatory.

- IRS Form 1099-DA will begin showing up in 2026.

- Exchanges often don’t support reporting for self-custodied assets.

Smart tax professionals are combining tax reporting, audit defence, and DeFi accounting into premium advisory services.

– Saim Akif, founder, Akif CPA

Keep Reading

- Spanish banking giant BBVA tells wealthy clients to invest 3 to 7% of their portfolio in bitcoin.

- The U.S. Senate passed the Genius Act, paving the way for stablecoin adoption.

- Thailand to exempt capital gains on crypto investments for 5-years.

- CoinDesk Overnight Rates (CDOR) become available to support stablecoin money markets based on Aave.